closed end loan trigger terms

For example if a creditor states no annual fee no points or we waive closing costs in an advertisement additional information must be provided. A trigger term is used when advertising what type of credit plan.

A Refresher On Triggering Events Impacting The Revised Loan Estimate Wolters Kluwer

If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2.

. Only 300 origination fee. For closed end dwelling-secured loans subject to RESPA if the APR stated in the early disclosure is not considered accurate under 22622 when compared to the APR at consumation does it appear corrected disclosures of all changed terms including the APR are provided no later than three 3 business days before consummation. If the features of the skip payment program are disclosed in the account-opening disclosure the credit union does not have to provide a change-in-terms notice.

Additional dwelling secured closed-end loans requirements. Thus for most closed-end mortgages. Heres a quick review of the Triggering Terms that come straight from Reg Z 102624.

However the APR is a triggering term for open-end credit. The amount of the down payment expressed either as a percentage or as a dollar amount. Subpart A sections 10261 through 10264 of the regulation provides general information that applies to open-end and closed-end credit.

Closed-End Credit Disclosure Forms Review Procedures. Comments 20a-3ii and 3iv. 10 20 or 30 year mortgages.

Triggering terms are defined by the Truth in Lending Act TILA and are designed to protect consumers from predatory lending practices. Finance Charge Accrual Timing. If any of the triggering terms listed above are included in an advertisement the.

These provisions apply even if the triggering term is not stated explicitly but may be readily determined from the advertisement. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID. Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures as set out here.

90 financing. 3 The amount of any payment. The Credit Union will comply with the Truth-in-Lending Act and its implementing regulation Regulation Z by providing consumer borrowers with proper Truth-in-Lending disclosures for closed-end credit in a timely manner.

There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. The APR is not a trigger if its a closed-end loan. In the event a financial institution furnishes negative information to a credit bureau for use on a consumers report which of.

The triggering terms are. Negative as well as affirmative references trigger the requirement for additional information. Disclosure Requirements for Skip-a-Payment Programs.

Refinancing provisions governing whether changing to a particular replacement index is considered a refinancing and triggering for example new transaction disclosures as applicable 12 CFR 102620a. See comment 16d-4 regarding the use of a phrase such as no closing costs. 12202013 General Policy Statement.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by. Up to 48 months to pay 90 percent financing As low as 50 a month 36 equal payments 500 total. Or 4 The amount of any finance charge.

2 The number of payments or period of repayment. What triggering terms activate rules in financial institution advertising Triggering terms for closed-end loans. The amount of any payment expressed either as a percentage or as a dollar amount.

Different sets of triggering terms apply to closed-end credit products such as mortgages and open-end credit products such as home equity lines of credit HELOCs. 3 Other Closed-End Products and Services eg Auto Loans Personal Installment Loans. Credit such as credit cards or home-equity lines or closed-end credit such as car loans or mortgages.

D Advertisement of terms that require additional disclosures 1 Triggering terms. For instance a few terms for closed end credit that trigger the need for additional disclosure are. If more than one interest rate will apply.

Amount or percentage of any down payment Number of payments or the period of repayment Payment amounts The finance charge Use of any of these terms requires clear and conspicuous disclosure of the following additional information. Under 102624 d 1 whenever certain triggering terms appear in credit advertisements the additional credit terms enumerated in 102624 d 2 must also appear. RV loans up to 108 months.

Except for home equity plans subject to 102640 in which the agreement provides for a. Monthly payments less than 67. The amount or percentage of the down payment.

The trigger terms for closed-end loans are. Truth-in-Lending Disclosures for Closed-End Credit Revised Date. 25 down.

36 to 72 month auto loans. 1 The amount or percentage of any downpayment. Sometimes mortgage advertisers are not fully aware of the Regulation Z Triggering Terms rules that require additional disclosures to be made in your mortgage ad.

The periodic rate used to compute the finance charge or the annual percentage rate. Refer to Section 22624 for closed-end advertising requirements and Section 22616 for open-end advertising. Trigger terms when advertising a closed-end loan include.

Converting open-end to closed-end credit. Open-End Loan Disclosures for Skip a Payment. The skip payment features that would be.

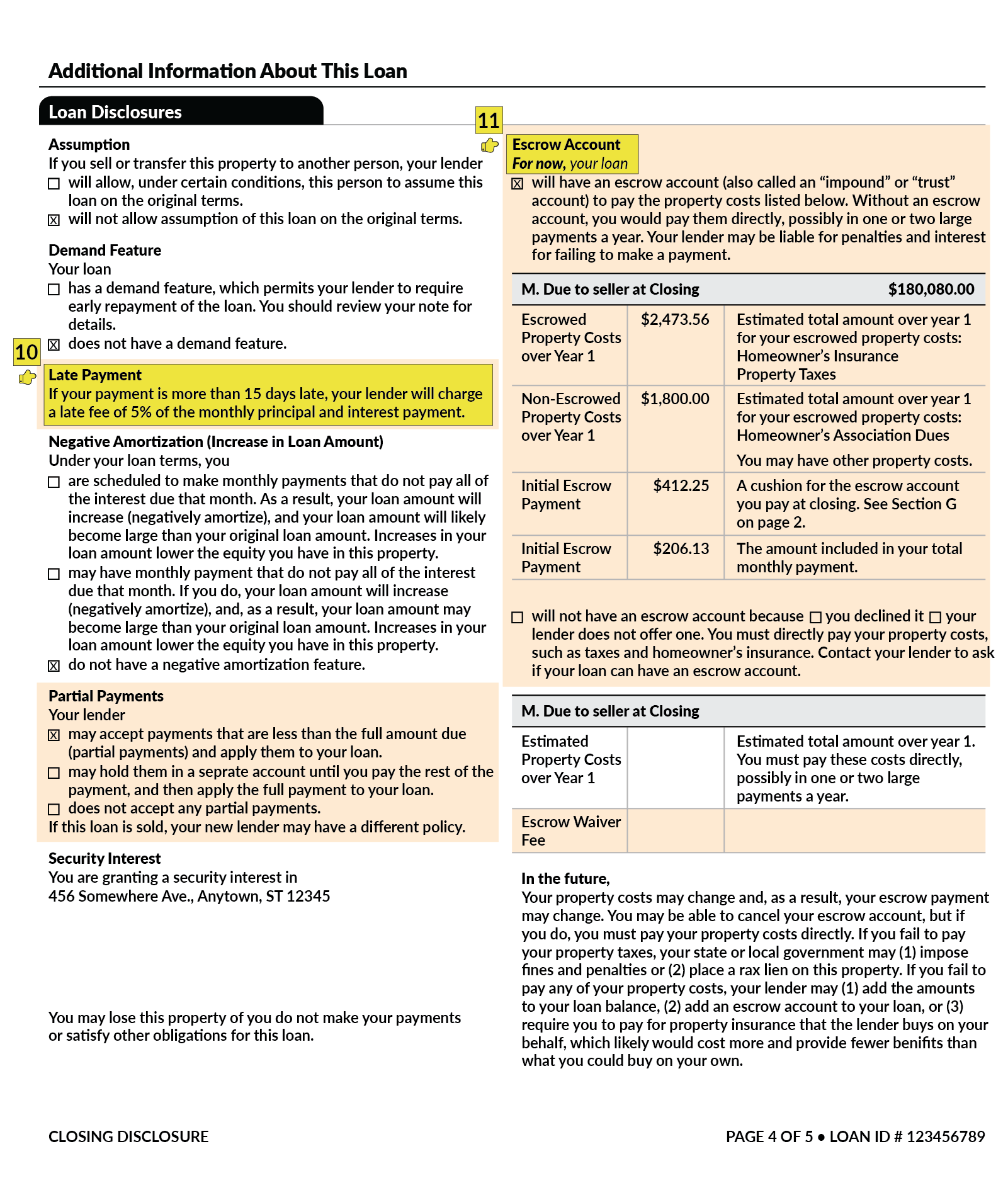

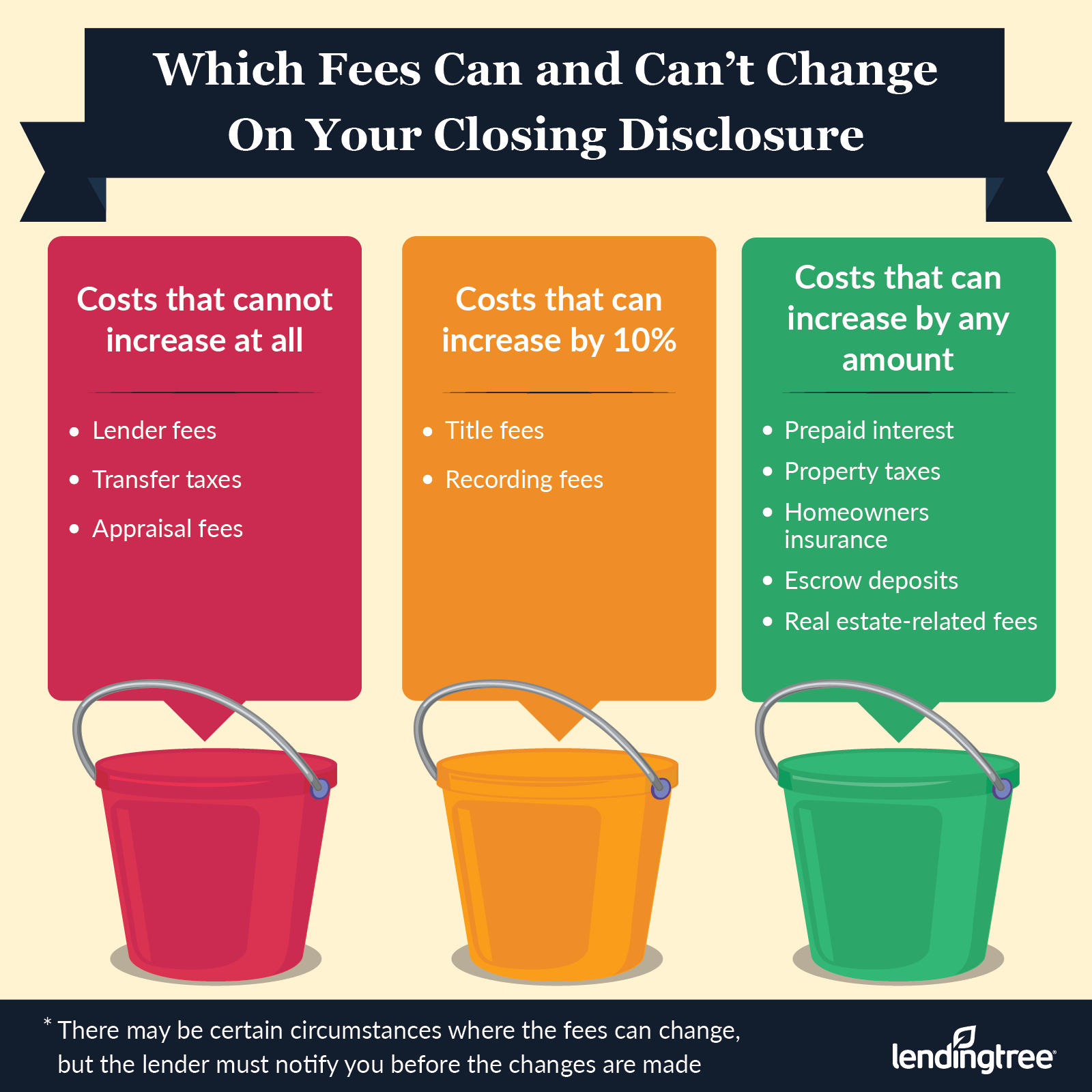

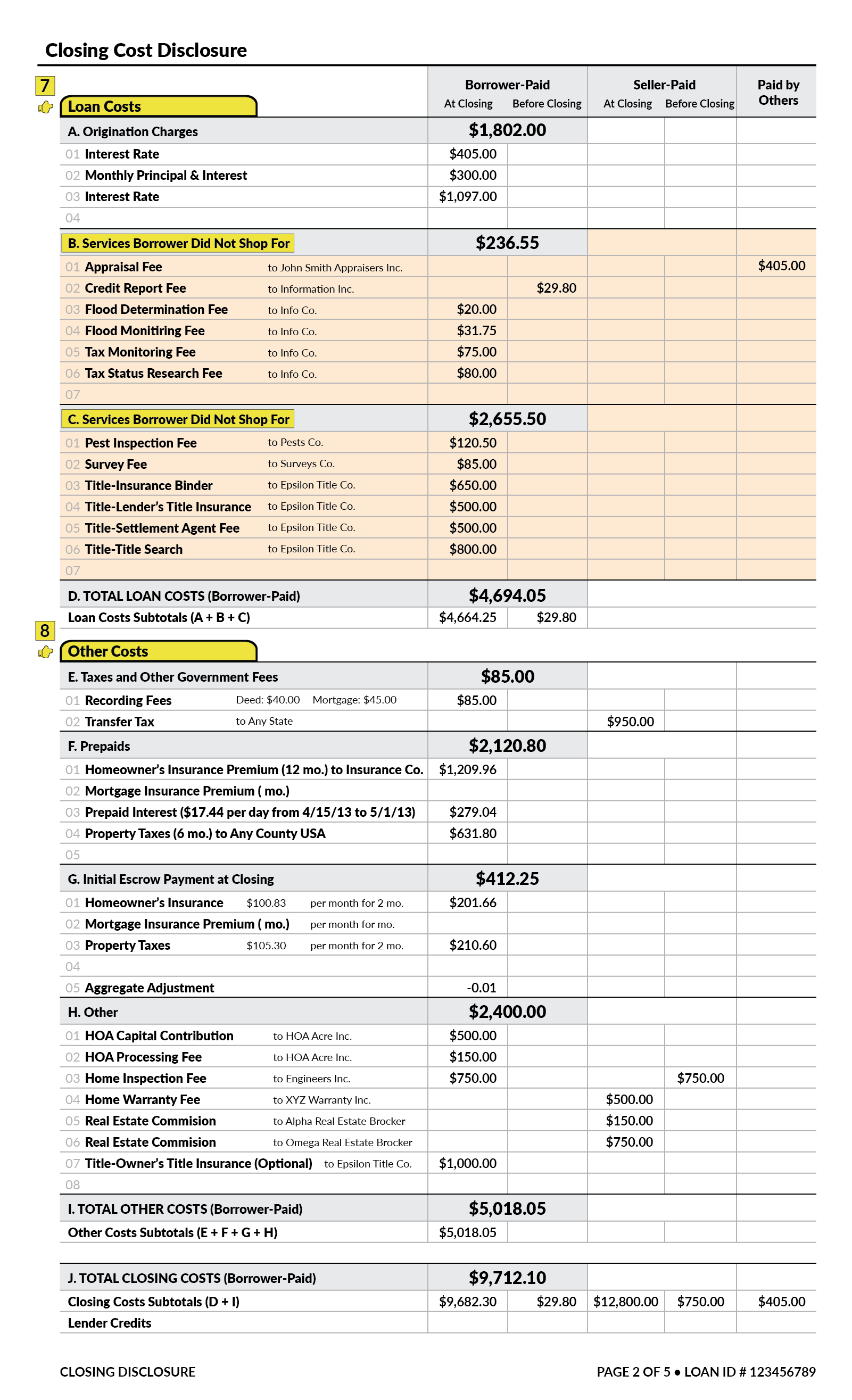

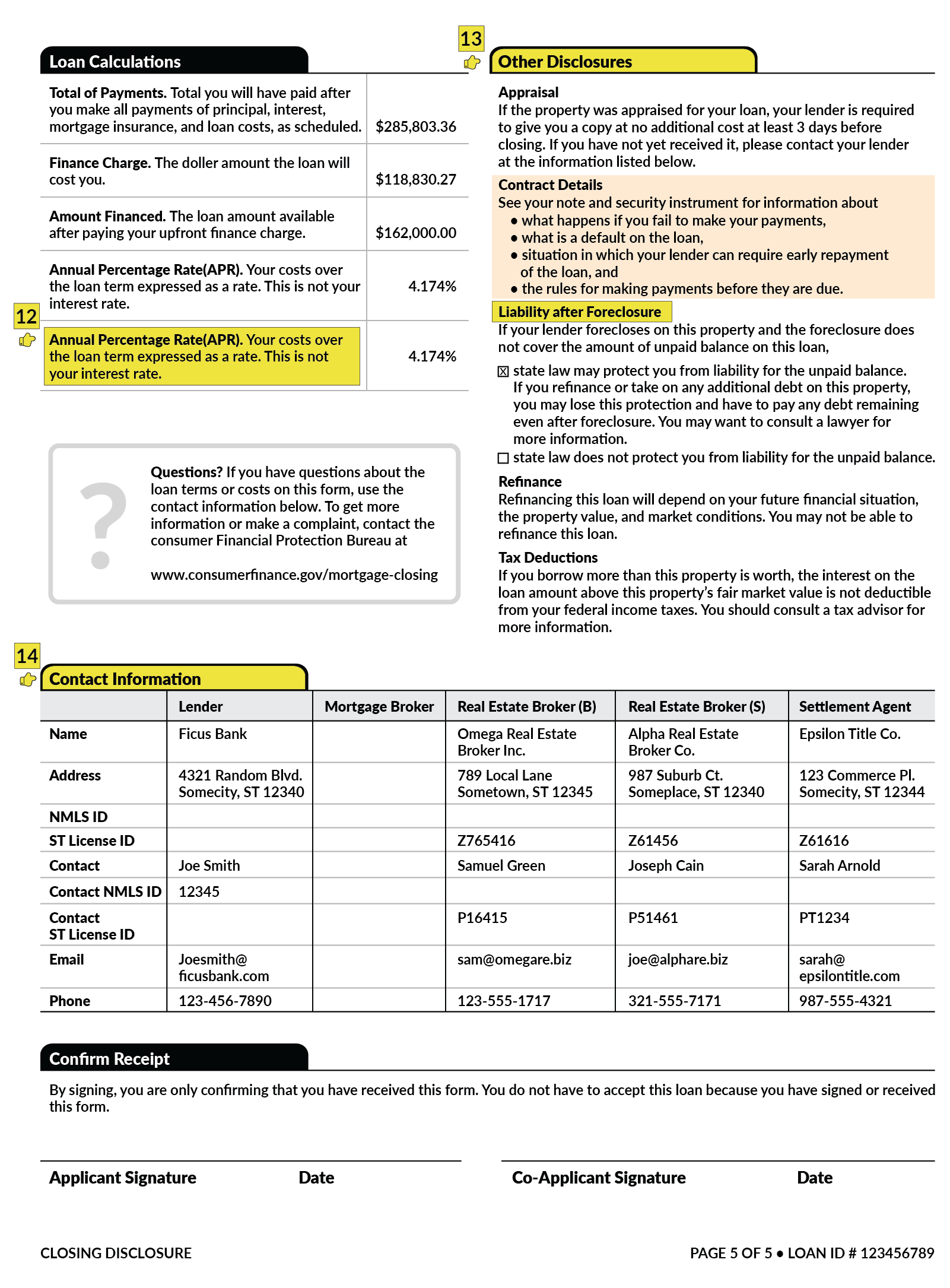

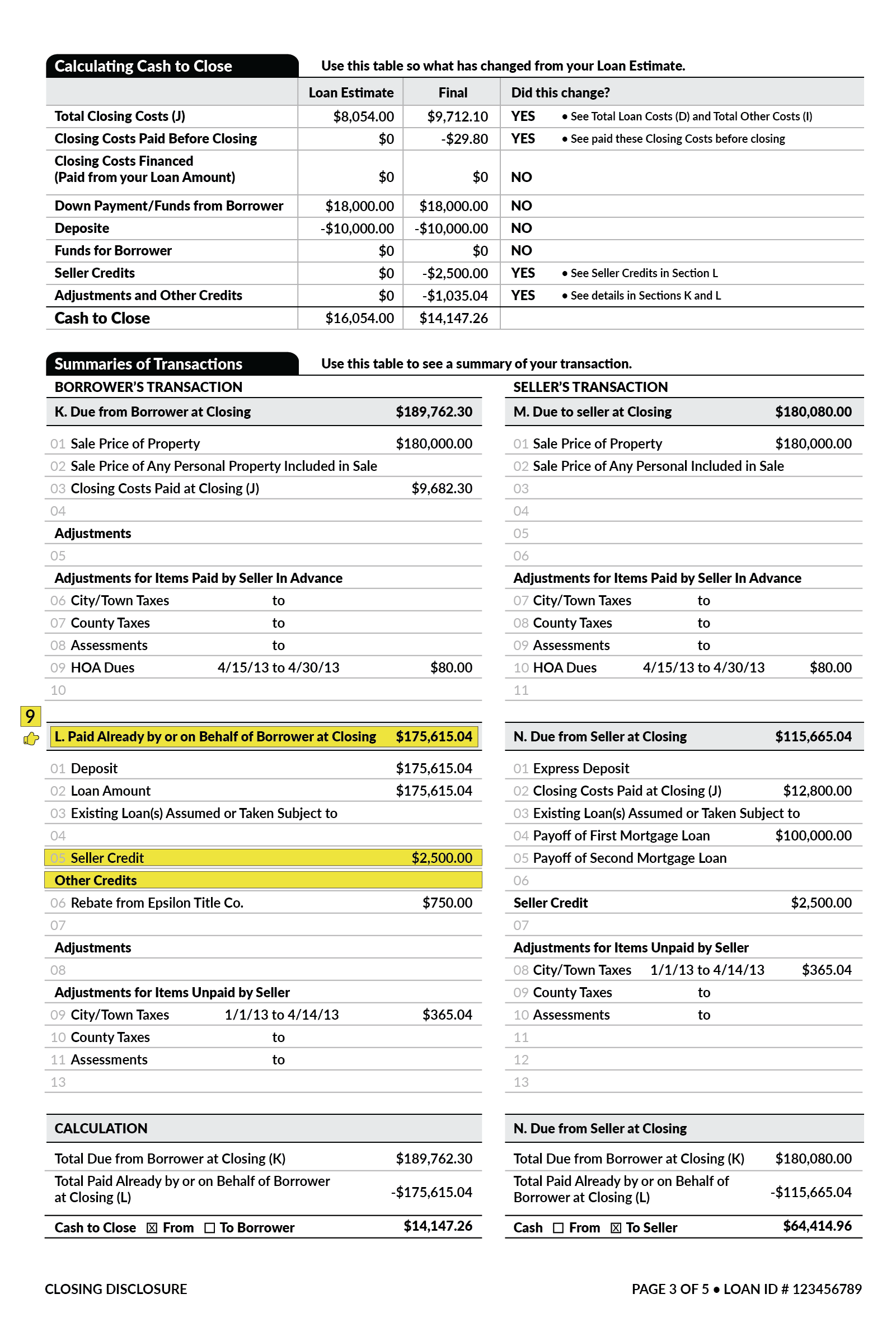

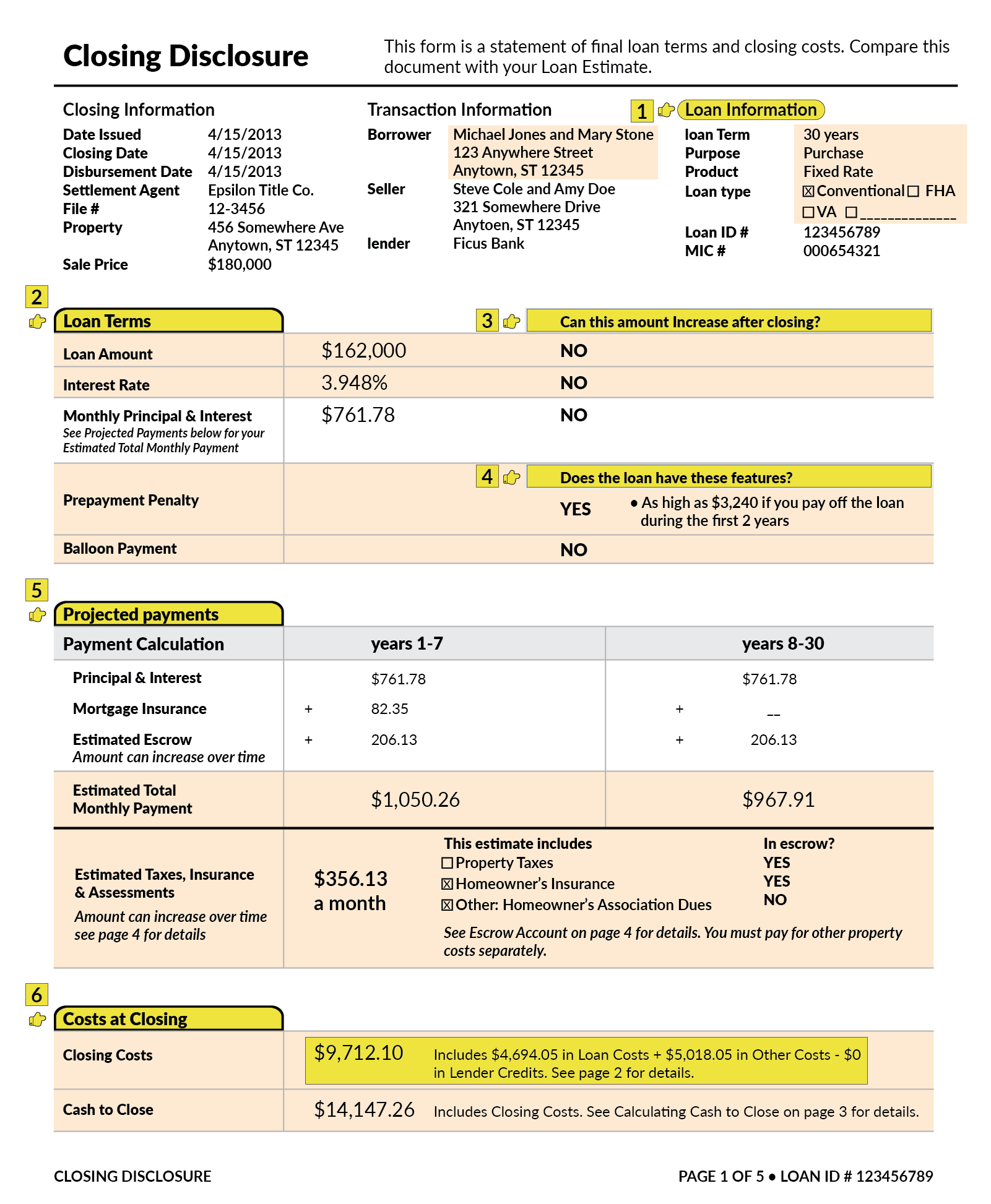

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Federal Register Truth In Lending Regulation Z

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Federal Register Truth In Lending Regulation Z

Federal Register Truth In Lending Regulation Z

Federal Register Truth In Lending Regulation Z

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)